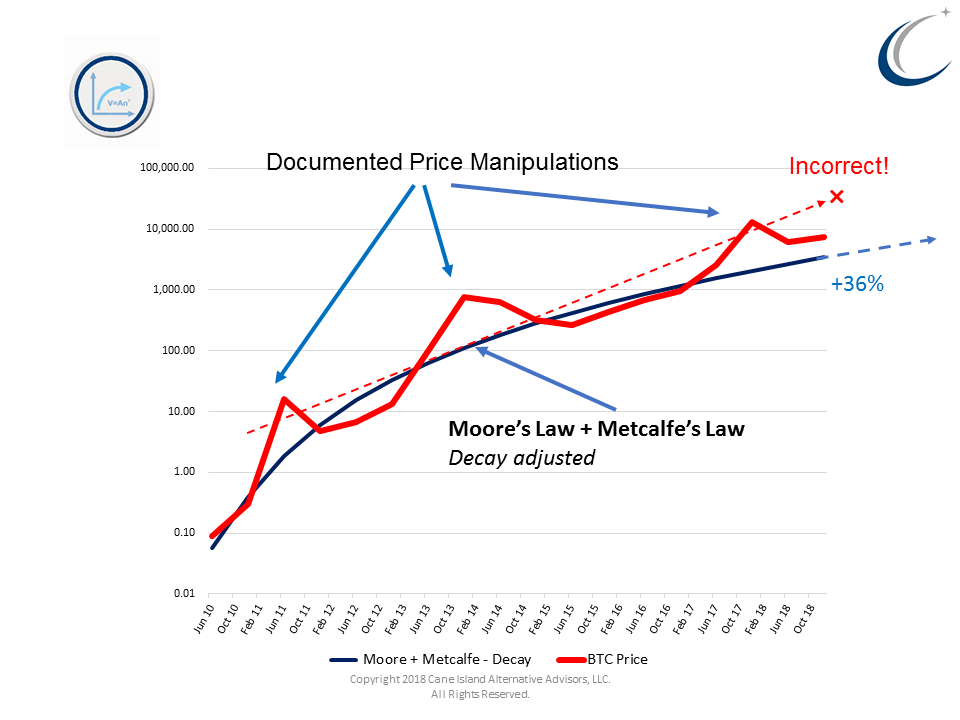

This is our live model of bitcoin’s equilibrium value. The equilibrium value is the fair value of bitcoin assuming there is an equally motivated buyer and seller in an efficient market (meaning participants have equal access to information).

I describe this as “live” because although prior to 2018 the model was backtested, 2018 data has been updated on a regular basis on this site (here). The red line is bitcoin’s actual daily price. The blue line is the theoretical value based on addresses, transactions, new coin issuance (inflation), and other factors. It is based on peer-reviewed, published work that we originated in 2017 (available here and here). The reversion to Metcalfe value in late 2018 only served to validate that we have the appropriate model parameters in place.

You don’t need the full formula and all the data to see that Metcalfe’s law is the single greatest explanation of bitcoin’s value over time. Here is a simple graph of active addresses (squared) vs. bitcoin price. Pretty convincing that Metcalfe’s law is exactly what it says it is: the value of a network. You can learn about Metcalfe’s law here.

Statistics 101

Models are just that – simplifications of the truth. With models come two kinds of errors: modeling error (the formula itself may be wrong or incomplete) and estimation errors (the output is not perfectly accurate). Assuming we have a decent model (again, see the addresses relationship above), we have an estimation error in our model of about 20% over a 60-day period. In other words, fluctuations of +/-20% around the “true” value of bitcoin are normal. Alternatively, the true value lies within +/-20% of the stated value (68% confidence), or +/-40% of the stated value (95% confidence).

Metcalfe’s law has a property which is its first derivative. It says that the change in price (P) is twice the growth rate in users (n): %∆P = 2 × %∆n. So if user growth is 10% per year, the price would go up about 20% that year. Of course, there is a margin of error, and so the actual price appreciation might be -20% to +60%, a range we would expect to see 95% of the time. It may seem like a large range, but it’s far more predictive than a wild guess, a talking head on TV, or short term chart analysis.

Assuming our model is (mostly) right and the value of bitcoin in January 2018 is (about) $3,600, then there is a 95% chance its real value is between $2,160 and $5,040.

Bitcoin’s price not entirely “propped up” by illegal activity

Now let’s assume that University of Sydney researchers are correct, and 25% of bitcoin transactions involve illicit activity. That does not mean that 25% of the users are involved in illicit activity, because one criminal can undertake many transactions. Also, a criminal may be on one end of a transaction and an unsuspecting innocent on the other. Based on a transaction-to-user ratio of 40%, a rough guess would be that 12.5% or fewer users are involved in illicit activity.

Now suppose that all of these bad guy users are caught and stop using bitcoin immediately. We mention this because some claim that bitcoin’s price is propped up by illegal activity. That is true, but to now we can quantify it: about 12.5% of users, on average, engage in illicit conduct with bitcoin. So if they went away we would have a -12.5% decline in user growth, which equates to a -25% decline in bitcoin price.

Using the low value of $2,160, and then applying a further 25% price decline, we get $1,620. This value assumes a) the 97.5th percentile of the valuation estimate and b) all bad guys stop using bitcoin.

You can argue the specifics of the numbers if you like, but changing the assumptions doesn’t change the circumstance. For bitcoin’s price to fall significantly all three of these things must be true:

there must be a lot of criminal users;

all the criminal users get caught and/or stop using bitcoin; and

Metcalfe’s law grossly overvalues bitcoin.

In other words, to arrive at low values for bitcoin, you have to have increasingly unrealistic and negative assumptions about the user base and Metcalfe’s law. In so doing, the probability of this negative occurrence becomes smaller and smaller. It becomes very difficult to find downward pressure on bitcoin price, even with perfect regulatory enforcement and large, pessimistic ranges for price estimates.

Add to that the fact that bitcoin is adding users at a rate of about 20% per year. This implies a 40% upside to price which would also have to be overcome. To us, it looks like there’s a 97% chance that $2,000 is a theoretical threshold bitcoin will not cross, and $1,500 is an impractical, if not impossible, bottom.